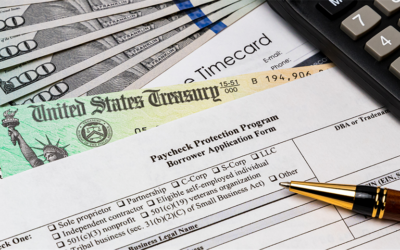

Most businesses are aware of the Payroll Protection Program (PPP), which included a first draw in 2020 and a second...

Finance Articles

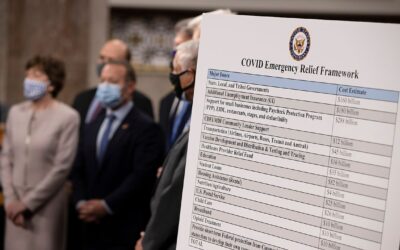

Regional Experts Offer Insights on PPP2 and Other Pandemic Aid Considerations

The U.S. Small Business Administration (SBA) opened the second round of the Paycheck Protection Program (PPP2) on...

The Latest Pandemic Relief Opportunities for Local Businesses

During the past two weeks, several Greater Palm Springs cities have initiated new grant and loan programs to assist...

Outlook: What’s Ahead for Taxes & Finances

In addition to being tax and finance experts as one of the region’s oldest and most respected CPA firms, Osborne...

New Year, New Outlook on Tax Matters

Looking to 2021, there will be many changes both in business and for us individually. With the new stimulus bills...

New Reporting Requirements for Independent Contractors

If you are an independent contractor, you’ll want to note that there are new reporting requirements for 2020. The IRS...

Managing the Revenue Cycle in Healthcare Practices

Revenue cycle management is complex and hard to manage, yet is vital to ensure that your medical practice is getting...

Required Financial Statement Changes for Homeowners Associations

In May 2020, the Financial Accounting Standards Board (FASB) – in response to COVID-19 – elected to again delay by one...

Agriculture Tax Laws: Navigating Properly Makes a Big Difference in the Bottom Line

There are many tax laws that are specific to agriculture which allow the accelerated write-off of certain structures...