In a move that has stirred both concern and speculation about the future of California’s geothermal ambitions, Black Rock Geothermal LLC – an indirect, wholly owned subsidiary of BHE Renewables (a Berkshire Hathaway company) – has requested a temporary suspension of its permitting process for three new geothermal power plants in the Salton Sea Known Geothermal Resource Area (KGRA). Each plant was slated to provide 77 megawatts of baseload, weather-independent renewable energy, carrying the promise of significant economic benefits for Imperial County and the broader region. Yet, prolonged permitting timelines, a lack of firm power purchase agreements, and complicated transmission interconnection studies have compelled the company to pause its efforts.

The three projects, collectively called the Black Rock Geothermal Project (BRGP), were designed to help meet California’s Mid-Term Reliability Decision – a statewide mandate requiring utilities to procure 1,000 megawatts (MW) of firm, weather-independent renewable energy by 2026. While geothermal fits neatly into that category, the complexities of building and interconnecting new facilities have proved daunting. The announcement of the suspension signals a sobering reality check for a region that has long touted geothermal and lithium extraction projects as the bedrock of a much-hyped “Lithium Valley.”

Below is a detailed look at how these challenges unfolded, the response from local agencies and stakeholders, and what it might mean for California’s ambitious renewables agenda.

A Project Years in the Making

Black Rock Geothermal LLC initially filed its Application for Certification (AFC) for the BRGP on April 18, 2023. By July 2023, the California Energy Commission (CEC) deemed that AFC complete, kicking off a mandated 12-month review period under the California Public Resources Code. The proposed geothermal plants, each at about 77 net megawatts of capacity, were expected to harness the Salton Sea area’s rich geothermal reservoir. Over time, BHE Renewables projected that the combined economic impact would surpass $1.39 billion, with job creation and extended benefits to “disadvantaged communities” cited as major selling points.

Despite early optimism, the regulatory timeline soon stretched beyond what developers and local officials deemed workable. On January 24, 2025, CEC staff filed a motion to extend the due date for the Final Staff Assessment of the BRGP. Black Rock Geothermal did not oppose that extension, yet it emphasized that much of the information requested was out of the company’s hands—hinting at a process that had grown unwieldy.

From a local perspective, the proposed new power plants would have served as anchors of a broader regional development strategy. Dubbed “Lithium Valley” by many advocates, the Salton Sea region is rich in both geothermal heat and lithium deposits. The synergy between the two resources is often cited as the future cornerstone of Imperial County’s economic revitalization.

Regulatory Delays and Uncertainties

A significant part of the BRGP’s predicament can be traced to the Mid-Term Reliability Decision (Decision 21-06-035) by the California Public Utilities Commission (CPUC). Under that directive, load-serving entities (LSEs) – utilities or other energy providers with CPUC oversight – must bring 1,000 MW of baseload, weather-independent renewables online. Black Rock Geothermal saw this as a market signal of California’s support for geothermal, reasoning that firm power capacity from the Salton Sea would help stabilize a state grid increasingly reliant on intermittent solar and wind resources.

Yet, procurement from these LSEs never materialized as expected. As of August 8, 2024, only 61% of the required long-lead time baseload capacity had been contracted statewide, with geothermal accounting for merely 37% of that total. Without clear off-take agreements—essentially, binding contracts guaranteeing a buyer for the generated power—financing and interconnection studies for the BRGP became far more tenuous.

Imperial Irrigation District (IID) transmission studies compounded Black Rock’s difficulties. In June 2024, IID notified the company that a restudy was necessary because a higher-queued project had withdrawn. Then, federal regulatory shifts required IID to implement new Open Access Transmission Tariff (OATT) requirements, effectively delaying any conclusive interconnection plan for the BRGP. The repeated restudies, and the uncertain timeline meant ballooning costs with no definitive path forward.

The Decision to Suspend

By early 2025, Black Rock Geothermal had reached a critical juncture. The prolonged permitting process, ambiguous procurement landscape, and interconnection obstacles collectively undermined the project’s near-term feasibility. On February 7, 2025, the company formally requested that the CEC put the AFC on hold for the BRGP. Shortly after, similar motions were filed for BHE Renewables’ Morton Bay Geothermal Project and Elmore North Geothermal Project, which also lie in the Salton Sea area.

A Black Rock representative summarized the dilemma succinctly: “Despite California’s undeniable need for firm, baseload, renewable power to meet its renewable energy and climate policy objectives, and the State’s authority to purchase geothermal energy through the Central Procurement Entity, to date, the BRGP has not been contracted. … We have no choice but to suspend the permitting process.”

In suspending the proceedings, the company hopes to buy time to explore transmission interconnection options, finalize any off-take agreements, and assess whether the Salton Sea’s geothermal potential can ultimately overcome the bureaucratic and market challenges.

IID Responds: ‘We Remain Ready to Assist’

The Imperial Irrigation District, whose service territory already hosts over 750 MW of geothermal energy and 700 MW of solar and storage capacity, responded quickly to BHE Renewables’ move. In a press release, IID emphasized that the suspension has no bearing on existing geothermal facilities in the region. The district noted it “has worked extensively to facilitate the development of the Black Rock geothermal plants and 4,000 MW of renewable energy projects seeking to interconnect to IID’s system.”

However, from IID’s perspective, certain complexities were unavoidable. Location-specific requirements, high construction costs, and the withdrawal of a higher-queued project triggered reanalysis under the OATT. That reanalysis, in turn, was delayed by new cluster rules, leaving Black Rock’s queue status in limbo. Despite the obstacles, IID Board Chairwoman Gina Dockstader said, “We remain ready to assist Black Rock and others in identifying viable paths forward.”

In a similar vein, IID General Manager Jamie Asbury underscored the district’s commitment to exploring solutions and assisting all interconnection customers. IID believes geothermal energy remains a key component of the region’s renewable future and aims to streamline processes where possible.

Local Officials and Community Groups Weigh In

Reactions from local officials reflect a mix of disappointment and cautious optimism. Imperial County Supervisor Ryan Kelley indicated the county would develop a plan to address geothermal industry concerns, asserting: “We have every interest for Berkshire Hathaway to be part of Lithium Valley.”

Many in the region had hoped for the BRGP and the two additional geothermal projects – Morton Bay and Elmore North – to serve as pillars for economic revitalization. According to an economic impact analysis commissioned by BHE Renewables, each of these plants would have contributed to job creation and significant boosts in tax revenue for local jurisdictions. The combined 30-year economic impact of the three proposed plants was pegged at over $4 billion, with upward of 1,500 construction jobs and nearly 200 permanent operational positions.

Beyond job prospects, local community organizations such as the Imperial County Workforce Development Board and the Imperial Valley Community Foundation have voiced their support for the BRGP. Other groups, including the American Civil Liberties Union of San Diego, Imperial Counties, and the Imperial Valley Equity and Justice Coalition, had questioned environmental justice, air quality, and groundwater use.

Luis Olmedo, Executive Director of Comité Cívico del Valle, posted online that the IID’s transmission process and the project’s environmental reviews merit careful attention. He stressed the importance of neither overburdening the region’s residents with added costs nor ignoring the need for responsible stewardship of local resources. “IID needs to maintain a healthy infrastructure, so does the rest of our ecosystem, infrastructure, public service, health support system, and equitable public benefits,” wrote Olmedo.

Academic Insight: A Pause, Not a Full Stop

According to Professor Michael McKibben of the University of California, Riverside, this suspension does not necessarily mean the end of geothermal development in the Salton Sea KGRA. “Their intent is to undertake further evaluation of the interconnection options for geothermal resources in the Salton Sea KGRA, energy offtake contracting opportunities, and other development challenges, and to determine whether these are obstacles that can be addressed,” McKibben noted in a recent social media post.

He explained that BHE Renewables had pursued development in the Salton Sea KGRA after interpreting CPUC’s Mid-Term Reliability Decision as a clear sign that baseload geothermal would be in high demand. From McKibben’s standpoint, it remains plausible that the state could still leverage these resources—once key procurement and transmission issues are resolved.

An Uncertain Future for ‘Lithium Valley’

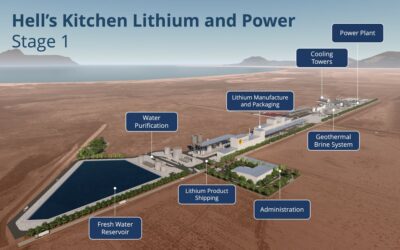

The suspension of these three geothermal projects also throws into question the broader momentum behind “Lithium Valley,” where local leaders have envisioned an integrated approach to harnessing lithium extraction from geothermal brine and the continuous stream of clean energy. The region’s lithium deposits have been touted as among the largest in North America, potentially fueling a domestic supply chain for electric vehicle batteries.

Yet, as Black Rock Geothermal’s predicament highlights, even the most resource-rich environment can be derailed by the confluence of policy, financing, and infrastructure challenges. For some, the question is whether state agencies, local stakeholders, and private developers can streamline processes to prevent the region from missing a pivotal moment in the global energy transition.

Statewide Implications

California’s renewable energy goals remain some of the most aggressive in the nation. Experts and policymakers have often cited geothermal as the indispensable counterpart to solar and wind, offering a constant and reliable power source. However, the difficulty in securing long-term power purchase agreements for new geothermal capacity underscores a deeper issue: LSEs have historically gravitated toward lower-cost renewables, with battery storage bridging shortfalls.

This trend may leave geothermal – and its relatively higher upfront capital expenditures – in a tough spot. Even with the state’s push toward net-zero emissions, policies must align with market realities. The absence of a guaranteed offtake for the BRGP reflects how that alignment has not yet been achieved. Some advocates hope that the California Energy Commission or the CPUC might instigate more centralized procurement of geothermal power, recognizing its strategic importance for overall grid stability and carbon reduction.

Economic and Community Impact

For Imperial County – where unemployment rates have hovered far above state and national averages – these geothermal projects represented more than just energy infrastructure. They were potential catalysts for long-term employment, local business growth, and added revenue for schools and public services. Officials have characterized the projects as integral to the county’s strategy to diversify an economy historically dominated by agriculture.

With the three BHE Renewables projects on hold, local leaders and community groups are calling for renewed efforts to resolve the bottlenecks. Stakeholders point to the possibility of bridging collaboration: for instance, forming partnerships that help finance the costly interconnection upgrades or lobbying for state-level policies that guarantee offtake agreements for baseload renewable energy.

Nonetheless, the indefinite nature of the suspension generates uncertainty for potential investors and local workers alike. For a county already grappling with poverty levels around 20% and an unemployment rate nearly three times the national average, the pause in development is especially poignant.

Looking Ahead

For now, Black Rock Geothermal LLC says it will use the suspension period to explore transmission interconnection options, pursue potential off-take agreements, and confirm the overall viability of geothermal projects in the Salton Sea KGRA. The final decision by the CEC on whether to grant the suspension—rather than deny it or request additional information—will likely hinge on the motions filed by the company and any responses from other parties.

Should the CEC grant the suspension, the developer could revisit the project at a later date, possibly with more favorable contract terms or a more streamlined path to interconnection. If the motion is deemed denied or market conditions fail to improve, these three proposed plants may remain in limbo, narrowing the state’s options to secure firm, zero-carbon power.

Despite the setback, local stakeholders hope geothermal’s unique advantages—consistent baseload generation and low emissions—will eventually tip the scales. As IID Chairwoman Gina Dockstader said, “The Imperial Irrigation District is committed to supporting renewable energy and collaborating with developers to overcome challenges … We remain ready to assist Black Rock and others in identifying viable paths forward.”

In the broader context of California’s ambitious climate and energy agenda, the future of these projects will serve as a bellwether, revealing whether the state can align its regulatory frameworks, transmission systems, and financial mechanisms fast enough to capitalize on geothermal’s potential – and whether the Salton Sea region can fulfill its promise as a hub of clean-energy innovation.